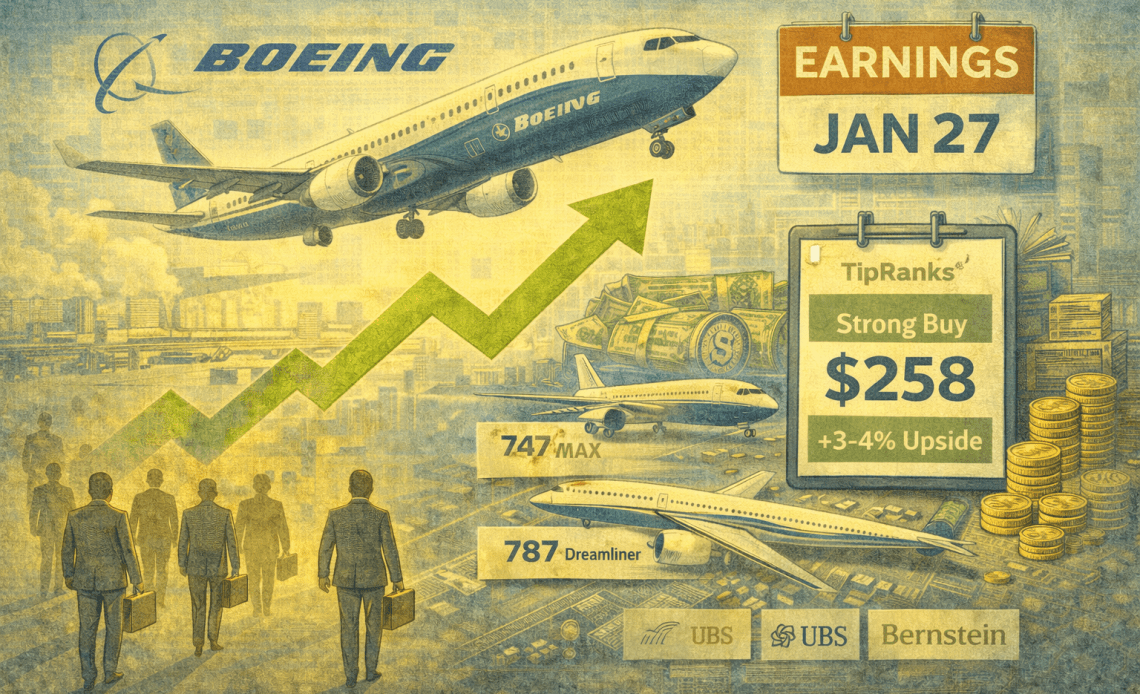

Boeing stock (NYSE: BA) appears poised for further gains heading into the company’s fourth-quarter 2025 earnings report on Tuesday, January 27.

Wall Street’s most bullish strategists are calling the aircraft manufacturer a top 2026 pick despite a 41% rally already in the books last year.

The question is whether analyst enthusiasm reflects genuine recovery momentum or merely reflects expectations already baked into the stock’s recent surge.

TipRanks data shows a consensus “Strong Buy” rating with an average price target of $258, implying just 3 to 4% upside from current levels.

Boeing stock: What Wall Street is pricing in ahead of Q4 earnings

Consensus estimates peg Boeing’s fourth-quarter loss at $0.37 to $0.44 per share on revenue of $22.4 billion, a dramatic improvement from the $5.90 loss in the prior-year quarter.

The 46% year-over-year revenue surge reflects the full-year 2025 delivery ramp that saw Boeing ship 600 aircraft, the highest annual total since 2018.

But what’s really capturing analyst attention is the earnings acceleration expected for 2026.

Wall Street forecasts Boeing will return to profitability with earnings of $3.00 per share next year, implying growth of 111%.

That trajectory attracted fresh upgrades with Bernstein analyst Douglas Harned recently naming Boeing stock his “top pick in the US for 2026,” raising his price target to $298.

UBS analyst Gavin Parsons highlighted a 69% surge in Dreamlifter cargo flights as evidence that 787 production momentum is genuine.

Tigress Financial set a $275 price target, noting Boeing’s record $600 billion backlog ensures revenue visibility for years ahead.

3 factors that matter more than you think

The real test arrives with management’s forward guidance and operational detail.

Investors will scan the earnings release and call for three critical data points.

First, confirmation that Boeing can sustain its jump in 737 MAX production to 42 aircraft per month during the first quarter.

The FAA approved this increase in October, but executing the ramp is different from receiving approval.

Second, evidence that the 787 Dreamliner program can progress toward its 10-per-month target by year-end 2026.

Third, management commentary on cash flow acceleration.

Boeing’s CFO recently noted that faster delivery rates will improve working capital, “freeing up cash” as the company cycles inventory more quickly.

If executives signal that 2026 cash generation will significantly exceed 2025 levels, the stock could break above analyst price targets.

The risks are real, though. Boeing stock already trades near 52-week highs. The 3 to 4% upside implied by current price targets leaves little margin for error.

Investors should expect a watchful market reaction as buy-the-news scenarios are possible only if Boeing surprises with aggressive 2026 targets.

The post Is Boeing stock a buy ahead of Q4 earnings? Here’s what analysts say appeared first on Invezz