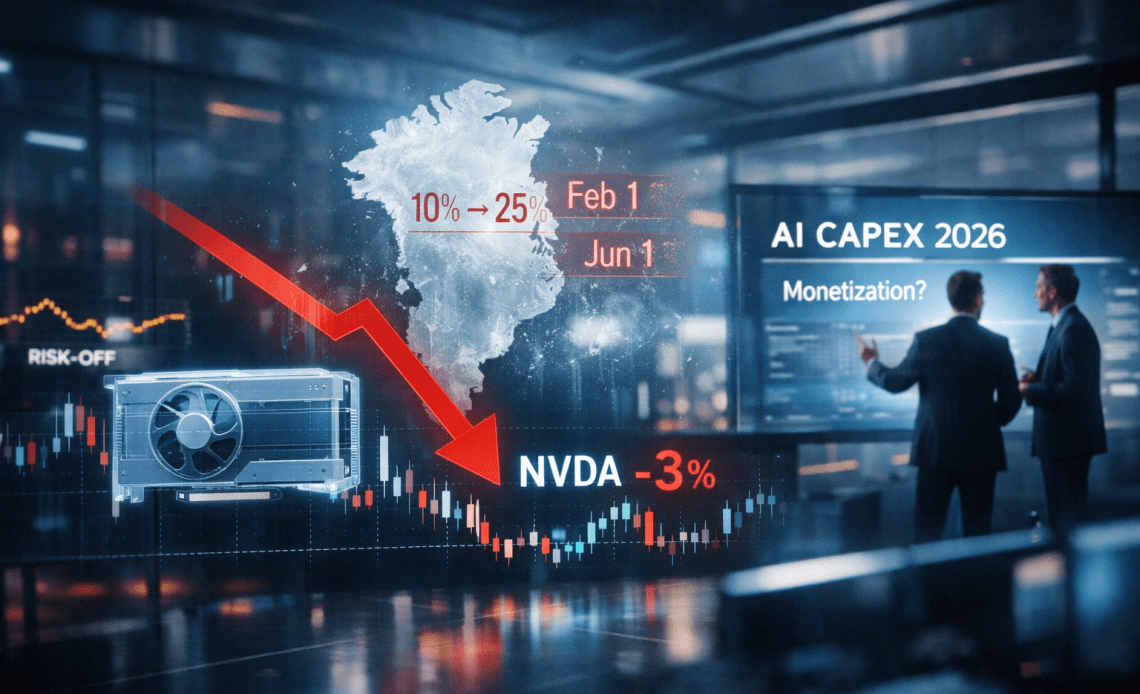

Nvidia stock (NASDAQ: NVDA) tumbled over 3% on Tuesday as the tech sector faced uncertainty over President Trump’s escalating Greenland acquisition push, triggering a broad risk-off unwind.

Simultaneously, influential analysts warned that 2026 could be the year AI infrastructure spending growth finally decelerates, forcing a rethink on whether hyperscalers can monetize hundreds of billions in capital expenditure.

Nvidia stock: Geopolitical trigger and trade war anxiety

The immediate catalyst is Trump’s tariff escalation over the Greenland stalemate.

Starting February 1, the UK, Denmark, France, Germany, Norway, Sweden, Finland, and the Netherlands face 10% tariffs on all exports to the US, rising to 25% by June 1 unless a territorial deal materializes.

Markets read this differently than transactional trade disputes.

Traders price territorial ambition tied to national security as less negotiable and more prone to escalation.

For Nvidia stock specifically, the concern cuts deep.

The market is repricing the probability that Trump’s aggressive posture extends beyond Greenland to broader China export restrictions, supply chain chaos, and European retaliation that would directly compress US tech margins.

Nvidia already faces headwinds in China sales, and fresh tariff uncertainty adds unpredictability to guidance.

The structural AI challenge: When the honeymoon ends

Deutsche Bank analysts Adrian Cox and Stefan Abrudan released a note on Tuesday titled “The honeymoon is over for AI,” challenging the assumption underpinning Nvidia’s bull case.

The thesis says 2026 will be tougher because expectations are colliding with supply bottlenecks, infrastructure constraints, and enterprises demanding proof that AI investments actually lift profits.

The numbers reveal the real problem.

Goldman Sachs forecasts cloud capex growth will decelerate to just 19–26% in 2026 versus 54% in 2025, a 50-to-65% slowdown.

While hyperscalers project $527 billion in AI capex for 2026, the growth rate is hitting a wall.

Amazon and Google are pulling back hardest (roughly 11% growth), while Meta remains aggressive at 42%.

That’s the demand cliff market watchers feared as capex growth slows, so does chip demand.

Moreover, the monetization question also haunts the investors.

OpenAI is projected to burn $17 billion in cash in 2026, up from $9 billion in 2025, with losses continuing through 2028 before any breakeven hope emerges in 2030.

When the largest AI customer is burning cash with no clear business model, questions about whether capex translates into proportional revenue growth intensify.

However, the bullish analysts also present a strong case.

Wolfe Research’s Chris Caso remains bullish, noting Nvidia trades at 23x forward earnings versus a five-year average of 35x, suggesting “attractive” valuation with $40 billion in 2026 revenue upside from Blackwell and Rubin’s 5x inference improvement.

Wall Street backs the Nvidia stock, but structural capex deceleration, combined with geopolitical uncertainty and AI monetization doubts suggests the chip giant faces a reckoning in 2026.

For investors, Tuesday’s selloff reflects repricing, a test of whether AI infrastructure capex can sustain growth baked into current valuations or whether 2026 becomes the year ROI skepticism forces a reset.

The post Nvidia stock plunges over 3% today: here’s why analysts think AI’s ‘honeymoon is over’ appeared first on Invezz